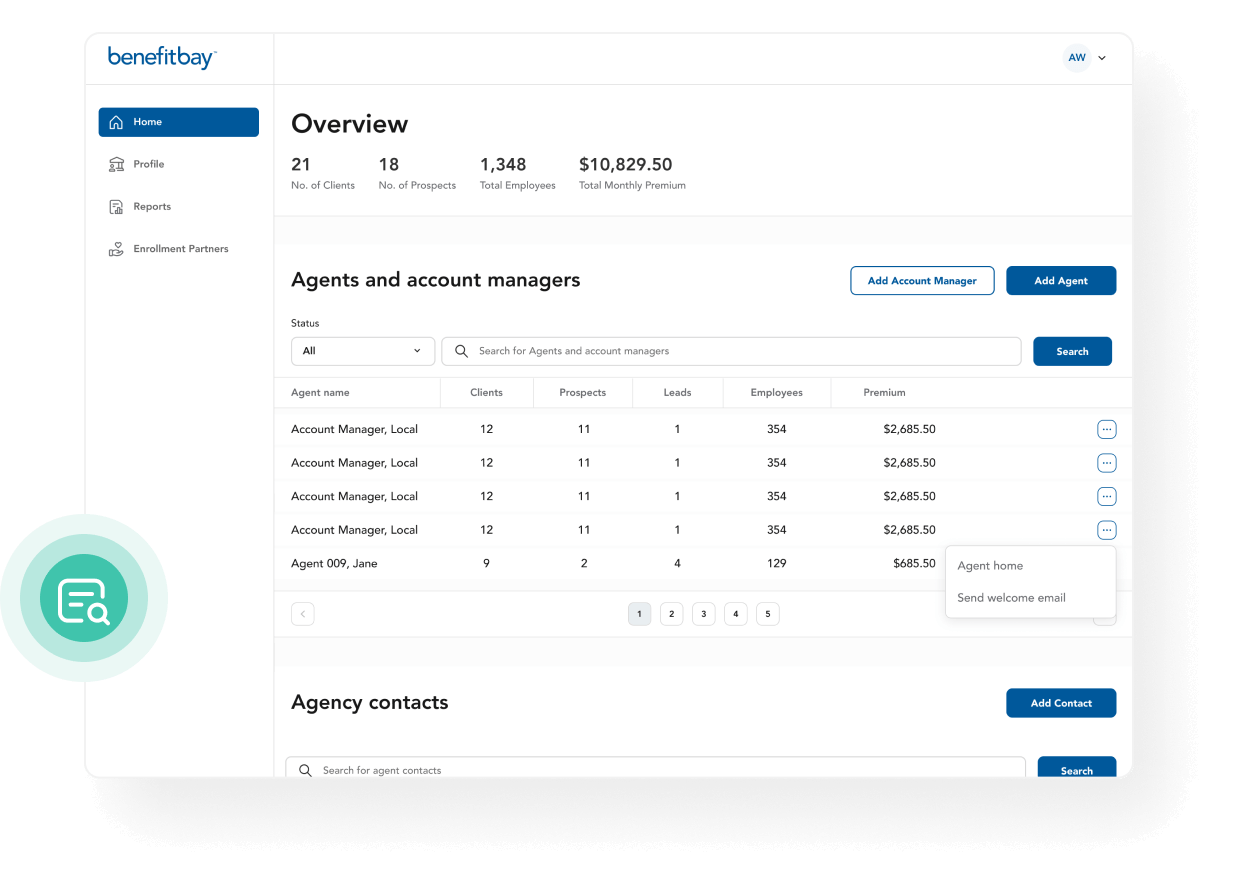

Why is benefitbay® better for agents?

The personalized benefit movement is here. Utilize benefitbay's® full sales suite by modeling ICHRA plans for all your clients effortlessly.

Get the most out of end-to-end ICHRA administration

At benefitbay® we are the platform that partners choose to deliver personalized benefits.

We empower agents to quickly add an ICHRA proposal to offer every client.

Check fit

Our Fulcrum tool enables agents to help clients preview how their company and employees may benefit from an ICHRA plan in minutes.

Model

Eliminate the burden of finding a group plan that works for every-one. Let your team decide!

Empower your team

Eliminate the burden of finding a group plan that works for every-one. Let your team decide!

Deploy

Advance Reimbursement Checking (ARC) Accounts are funded for automatic monthly premium payments. Pre-tax payroll deductions are set up for off-exchange plan documents and administrative reports are created.

Why is benefitbay® better than

other ICHRA platforms?

- Real time visualization of your ICHRA plan

- Set employers into classes with different contribution amounts

- Adjustments in real-time

- Provide employees with visibility of the government subsidy dollars available to them

- Advanced Reimbursement Checking (ARC) Accounts established for each employee.

- Accounts are set for automatic payment, pre-funded with the employer contribution and the employee’s portion of the premium

- Advanced Reimbursement Checking (ARC) Accounts established for each employee.

- A payroll file is provided for deductions

Other ICHRA Platforms

- Limited plan modeling functionality.

- Employers enter their information and, days later, receive a static proposal.

- No assurance of compliance, no ability to make changes without a lengthy delay.

- Employees may pay for their plan using an employer contribution, not realizing they could receive a higher level of financial support through available government subsidies.

- The employee pays the full premium and files for reimbursement as an expense.

- This often creates financial hardship or lapses in coverage for the employee and administrative burden for the employer.

- Real time visualization of your ICHRA plan

- Set employers into classes with different contribution amounts

- Adjustments in real-time

- Provide employees with visibility of the government subsidy dollars available to them

- Provide employees with visibility of the government subsidy dollars available to them

- Limited plan modeling functionality.

- Employers enter their information and, days later, receive a static proposal.

- No assurance of compliance, no ability to make changes without a lengthy delay.

- Employees may pay for their plan using an employer contribution, not realizing they could receive a higher level of financial support through available government subsidies.

Ready to join us?

Benefitbay® is designed with you in mind! We are an end-to-end ICHRA administration platform for insurance agents and their clients. We provide a comprehensive suite of tools for agents to offer an ICHRA solution for every client.

If you’re ready to model your ICHRA (it only takes a few minutes), click to schedule an introduction call with our team to discuss how benefitbay® and ICHRA are a fit for your team.